The federal government collects taxes to finance various public services. As policymakers and citizens weigh key decisions about revenues and expenditures, it is instructive to examine what the government does with the money it collects.

The federal government collects taxes to finance various public services. As policymakers and citizens weigh key decisions about revenues and expenditures, it is instructive to examine what the government does with the money it collects.

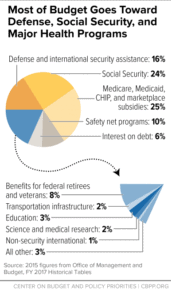

In fiscal year 2015, the federal government spent $3.7 trillion, amounting to 21 percent of the nation’s gross domestic product (GDP). Of that $3.7 trillion, over $3.2 trillion was financed by federal revenues. The remaining amount ($438 billion) was financed by borrowing. As the chart below shows, three major areas of spending each make up about one-fifth of the budget:

- Social Security: Last year, 24 percent of the budget, or $888 billion, paid for Social Security, which provided monthly retirement benefits averaging $1,342 to 40 million retired workers in December 2015. Social Security also provided benefits to 2.3 million spouses and children of retired workers, 6.1 million surviving children and spouses of deceased workers, and 10.8 million disabled workers and their eligible dependents in December 2015.

- Medicare, Medicaid, CHIP, and marketplace subsidies: Four health insurance programs — Medicare, Medicaid, the Children’s Health Insurance Program (CHIP), and Affordable Care […]

Did this reporter add in the hidden defense costs? IE all of the costs that were privatized under Bush 2. Rachel Maddows book goes into some of the detail on this issue.

I am grateful that you found and posted this article. It makes me feel a bit better that the defense budget isn’t as big as I had thought.

There is a reason for this common mistake in the media.

There are 2 types of spending discretionary and mandatory as broken down here:

https://www.nationalpriorities.org/budget-basics/federal-budget-101/spending/

for 2015.

Or directly from the government for 2016

https://www.cbo.gov/publication/52410

https://www.cbo.gov/publication/52409

These are snapshots of the discretionary and mandatory spending from the CBO.